For partnerships, each partners’ capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C). For corporations, Income Summary is closed entirely to « Retained Earnings ». The Income Summary balance is ultimately closed to the capital tax evasion and tax avoidance account. Closing the dividends or withdrawals account to Retained Earnings. We have completed the first two columns and now we have the final column which represents the closing (or archive) process. All accounts can be classified as either permanent (real) or temporary (nominal) (Figure 5.3).

Opening Entries in Accounting Ledgers

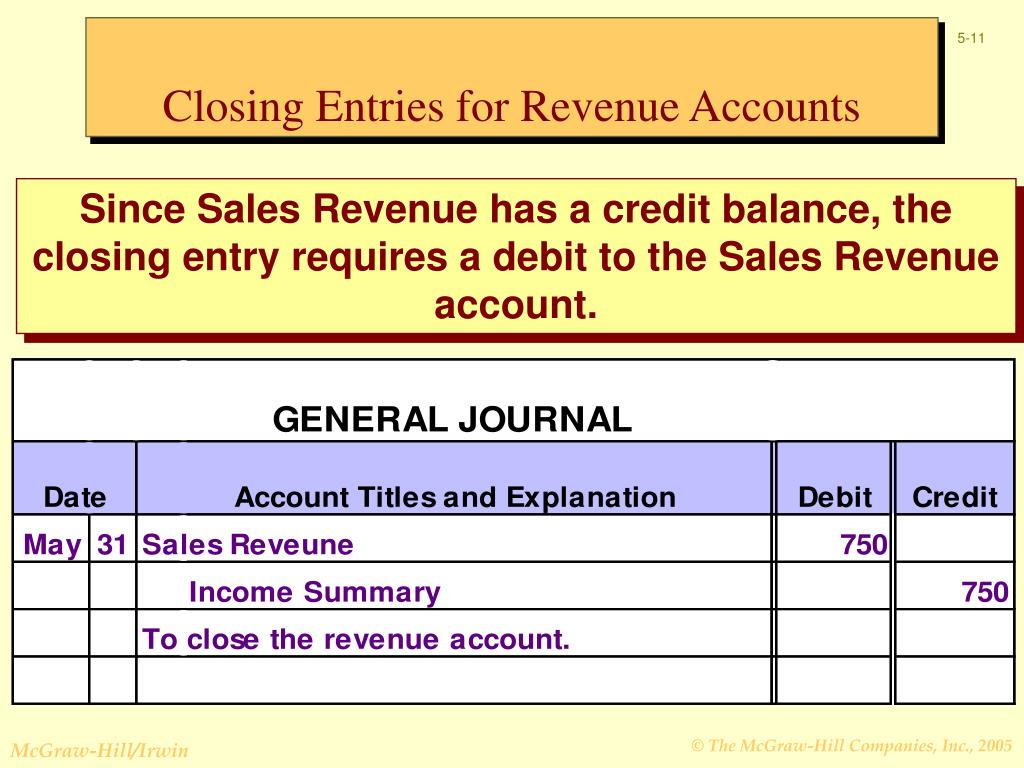

A closing entry is a journal entry made at the end of an accounting period. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. These accounts must be closed at the end of the accounting year. Your business will need to transfer the balances into the income summary account to close these revenue and expense accounts. The income summary account is another temporary account, only used at the end of an accounting period. This account helps businesses shift their revenue and expense balances from the temporary accounts into the permanent account known as retained earnings found on the balance sheet.

In which journal are closing entries typically recorded?

Cash payments (“cash disbursements”) include any payments made by cash, check, or electronic fund transfer. The same is true of your cash receipts journal, though this journal tracks the inflow, not the outflow, of funds. Now, all the temporary accounts have their respective figures allocated, showcasing the revenue the bakery has generated, the expenses it has incurred, and the dividends declared throughout the past year. The trial balance is like a snapshot of your business’s financial health at a specific moment.

Explore our full suite of Finance Automation capabilities

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

The Accounting Cycle

Imagine you own a bakery business, and you’re starting a new financial year on March 1st. Now that the journal entries are prepared and posted, you are almost ready to start next year. Remember, modern computerized accounting systems go through this process in preparing financial statements, but the system does not actually create or post journal entries. At the end of the year, all the temporary accounts must be closed or reset, so the beginning of the following year will have a clean balance to start with. In other words, revenue, expense, and withdrawal accounts always have a zero balance at the start of the year because they are always closed at the end of the previous year. The net income (NI) is moved into retained earnings on the balance sheet as part of the closing entry process.

File tax returns before we deactivate your EIN

Only income statement accounts help us summarize income, so only income statement accounts should go into income summary. What is the current book value of your electronics, car, and furniture? Are the value of your assets and liabilities now zero because of the start of a new year?

The closing journal entries example comprises of opening and closing balances. Opening entries include revenue, expense, Depreciation etc., while closing entries include closing balance of revenue, liability, Depreciation etc. Keeping your books balanced entails keeping a detailed record of all debits and all credits to each account.

- HighRadius has a comprehensive Record to Report suite that revolutionizes your accounting processes, making them more efficient and accurate.

- In this chapter, we complete the final steps (steps 8 and 9) of the accounting cycle, the closing process.

- You might be asking yourself, “is the Income Summary account even necessary?

- You will notice that we do not cover step 10, reversing entries.

Journal entries are transferred to the general ledger when they’re posted to an account, such as accounts receivable. Another essential component of the Highradius suite is the Journal Entry Management module. This module automates the creation and management of journal entries, ensuring consistency and accuracy in your financial statements. Organizations can achieve up to 95% journal posting automation with a pre-filled template, reducing errors and discrepancies and providing a reliable view of financial data. Closing entries are crucial for maintaining accurate financial records.

An accounting period is any duration of time that’s covered by financial statements. It can be a calendar year for one business while another business might use a fiscal quarter. The retained earnings account is reduced by the amount paid out in dividends through a debit and the dividends expense is credited. Closing entries are necessary to reset the balances of temporary accounts to zero and to update the Retained Earnings account. The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger.